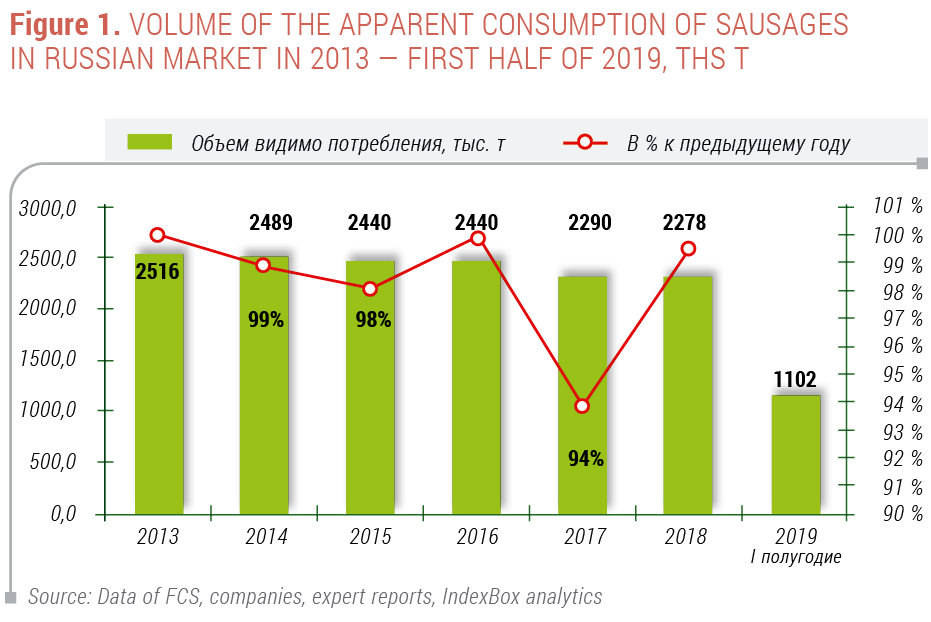

Since 2014, the apparent consumption[1] of sausages has been decreasing by the average annual rate of 2%, and as of year-end 2018, it was 2278 ths t. The negative market trend is related to the general crisis events in the economy, as well as to the import food ban and rising prices of raw materials, which together affected the changes in the final market demand.

As of the first half of 2019, the apparent consumption of sausages continued the trend of 2018, dropping by 2%, compared to the same period of the previous year (up to 1102 ths t). Furthermore, there is a decrease in the volume of production and imported products in the market structure due to the low demand for sausages and rising prices.

[1] The apparent consumption volume is equated to the market volume; this indicator reflects the product volume available for consumption in the domestic market. Furthermore, it is assumed that the reserves, left over stock and losses are included in the specified volume, but not distinguished separately.

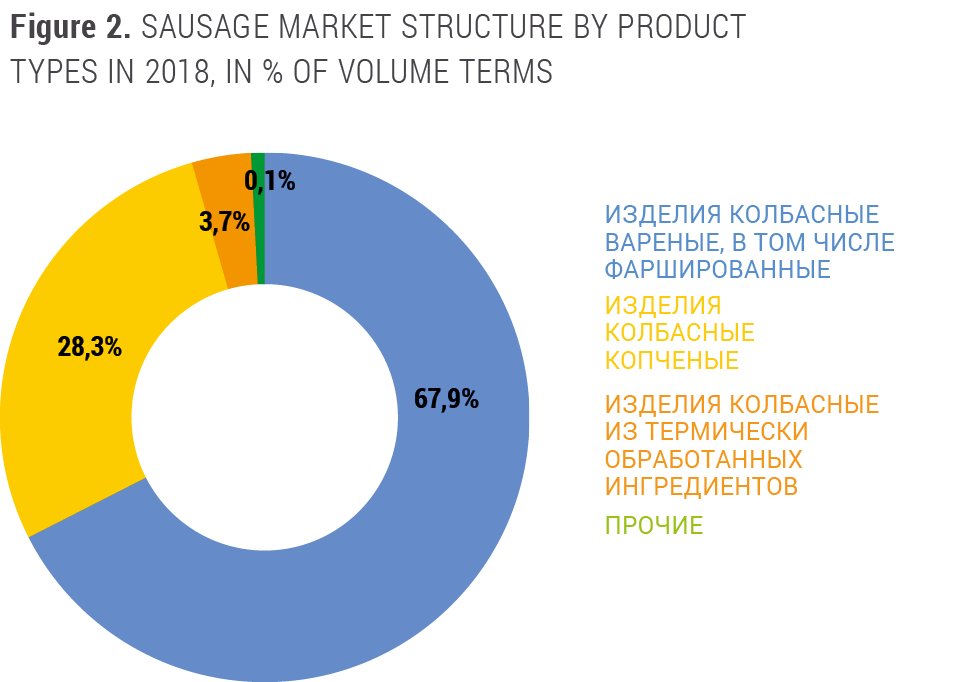

Cooked sausages are typically in highest demand, and their market share is 68% of the total market volume. They are followed by smoked sausages (28%). The market share of products made of heat treated ingredients, blood and fried sausages is no more than 4%. This structure resulted from the already established culture of sausage consumption and sausage prices: the prices of cooked sausages are much lower than the prices of the other kinds of sausages.

Sausage Production in Russian Federation

In 2013–2018, the sausage production rate showed a negative trend with the average annual decrease rate of 2%. 2017 saw another drop by 6% due to the continuous rise in prices of raw materials for sausage production, which, in turn, led to the increase of the consumer prices. Another factor is the significant increase in the expenses of sausage manufacturers which is related to the rise in water, electricity and logistic services rates.

In the first half of this year, the production volume was 1101 ths t, which is by 2% lower than in the same period of the previous year.

The Central Federal District is the leader in sausage production. In 2018, its market share was about 40%. It is followed by Volga Federal District and Northwestern Federal Districts with the market shares of 22% and 10%, respectively.

The sausage production structure by types is formed and relatively stable: with more than 50% attributed to stuffed sausages (cooked sausages, Vienna sausages, bratwurst).

Foreign trade operations in the market

The volume of imported sausages in 2015 was 28.5 ths t, which is by 44% lower than in 2014. The import volume drop is due to the current economic situation, ruble exchange rate fluctuations and the food import ban.

In 2016–2017, import showed growth, which reflected the foreign producers’ adaptation to the current economic situation in Russia. In 2018 however, import decreased again by 10%, which is related to the ban imposed by the Federal Veterinary and Phytosanitary Monitoring Service on the import of certain categories and brands of sausages from Belarus, which is the main supplier of those products to Russia (more than 94% of the total import volume).

In the first half of 2019, the volume of imports to Russia was 9.8 ths t, which is by 5% lower than in the previous year.

The sausage export showed unstable growth during the entire period, which is connected mainly to the exchange rate fluctuations. The main recipient of Russian sausages is traditionally Kazakhstan. In 2018, Russia exported 79% of the total export volume to this country. Ukraine was second with 10%.

In the first half of 2019, the volume of exports to Russia was 12.5 ths t, which is by 4% higher than in the previous year.

Prices in sausage market

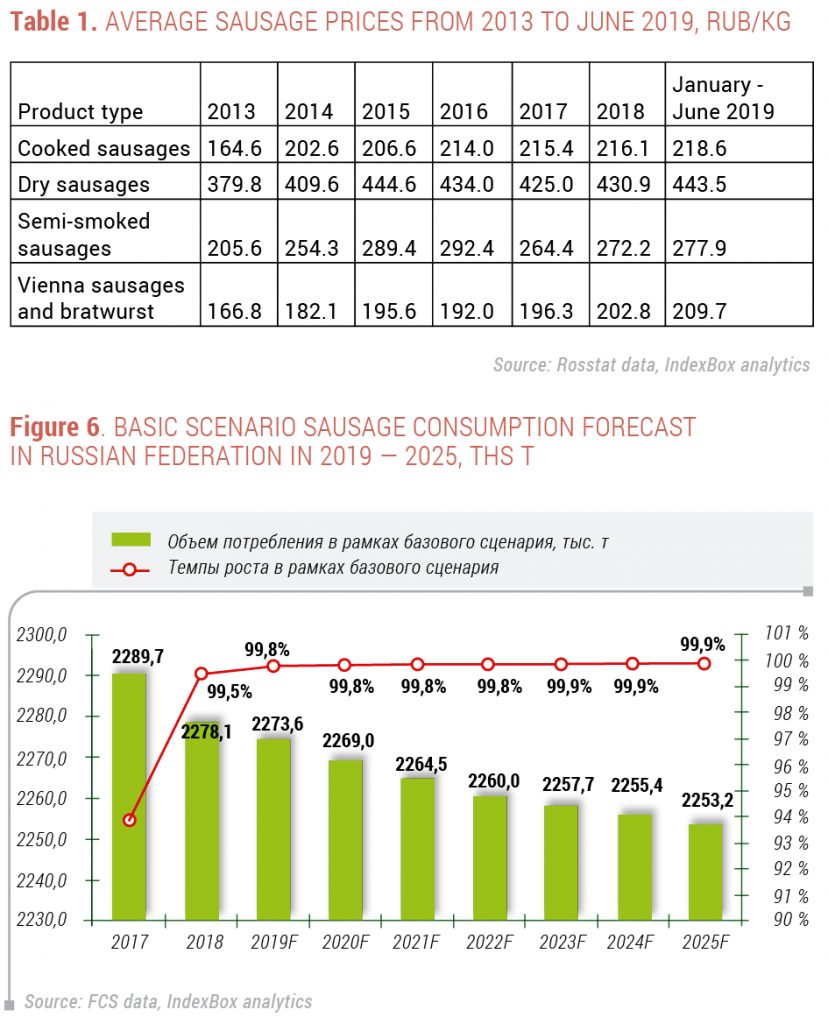

From 2013 to June 2019, the producer price trends diverged, which depends, above all, on the prices of raw materials and other producer expenses during that period of time. In 2013, prices remained stable. Since 2014 the average prices began to increase, and as of June 2019, the prices of cooked sausages were 393.3 RUB/kg, semi-smoked sausages — 478.1 RUB/kg, dry sausages — 475.2 RUB/kg. In June, the average price of Vienna sausages and bratwurst was 205.4 RUB/kg.

Sausage consumption volume forecast

Consumer demand for sausages as products that don’t fall into the category of necessities is the main factor that defines the market indicators and mainly depends on the income level and spending patterns of the population (especially in crisis periods), taking into account the product prices. Consequently, with the increase of product prices, the consumer demand for sausages may undergo structural changes (consumers will switch to cheaper products). The production prices and volumes, in turn, depend on the prices of raw materials, which show record growth during the last few years. The market development is also limited by import bans and the popularization of proper diet and healthy lifestyle in the last few years, due to which many consumers are interested in meat.

Hence, all these factors will lead to sausage market stagnation in the mid-term, and by 2025, the drop in sausage market volumes may reach up to 2253 ths t, which is by 1.1% lower than the consumption level in 2018.

AUTHORS

Maria Ayriyan

Specialist in the Analytical Department of IndexBox Russia

Source: sfera.fm